Briefly –

- Traders belied the bailout package by IMF will enhance economic indicators

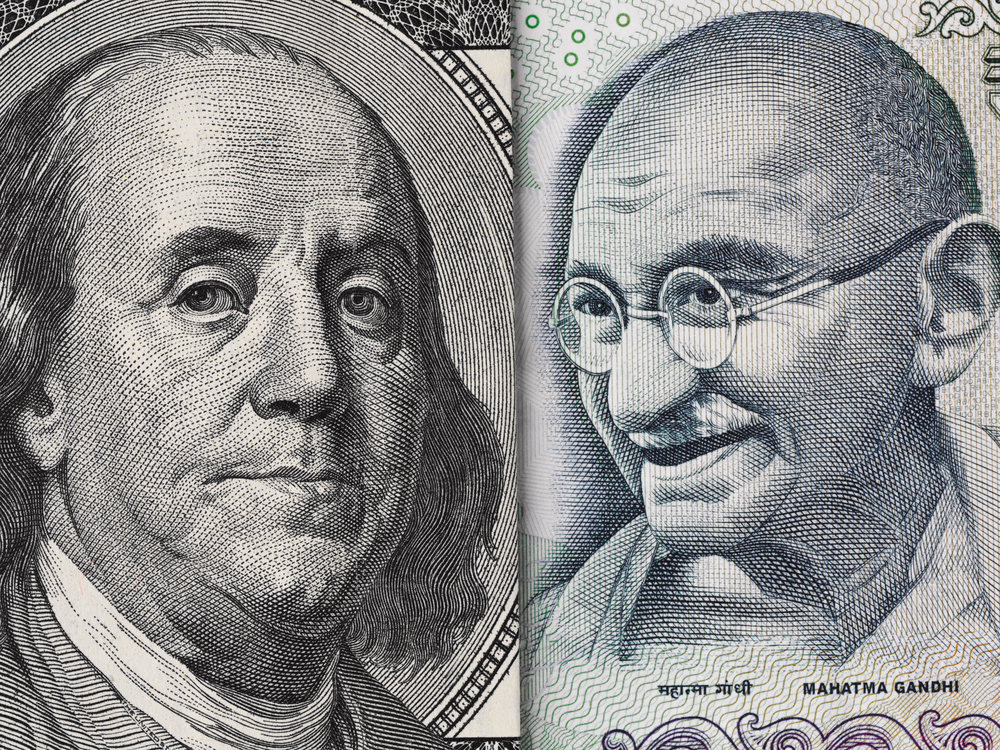

- The local currency gained about 3% against the USD in three sessions over the week.

- Global prices decline, and the nation’s political stability supports the

The Pakistan rupee will likely extend its upside trajectory amidst resurged optimism that IMF (International Monetary Fund) bailout package will kick start by 31 August. Investors trusts such developments enhanced economic indicators.

The local unit increased by about 3% against the USD in three sessions this week. Meanwhile, it maintained its upward trends, tracking gains within the local equity markets.

The rupee received support from eased U.S inflationary pressures, the nation’s stable political outlook, declined oil prices, and the greenback’s supply improvements because of export-associated proceeds.

Also, Pakistan’s dollar-denominated supreme bonds launched recoveries thanks to eased default fears. The nation’s 5-year default swap plunged to 17.44% on 10 August from the 34.86% peak of 20 July.

Nevertheless, foreign exchange reserves drained steadily. State Bank of Pakistan’s reserves declined by $555M to $7.83 billion by 5 August amid soared external debt payments.

The News revealed that market players expected the rupee to maintain upsides in the upcoming sessions following positive sentiments on hopes of IMF funds before the month ends. The money from International Monetary Fund will help alleviate the economy, scale up reserves and support the rupee.

The IMF summoned its execs on 29 August to approve Pakistan’s rescue package, including a $1.18 billion disbursement before 31 August.

The action comes after the conclusion of $4B bilateral funding from four friendly countries. And would clear the path for a prompt transfer from the International Monetary Fund, expected to arrive in Pakistan accounts by 31 August.

Miftah Ismail, Finance Minister, stated that the lender sent the LOI (letter of intent) on Friday for program resumption under SLA (staff level agreement) and MEFP (memorandum of economic & fiscal policies) – inked over last month.

The above indications support continued rallies for the Pakistan rupee. However, watching upcoming tendencies remains fascinating considering the global financial outlook.

Stay around for upcoming developments in the financial spectrum.